Coronavirus & Market Uncertainty - Focusing on the Big Picture

Understand how markets have performed, historically, during times of a crisis.

From newsprint to television, mobile notifications to online group chats, the world is in dire straits. The coronavirus is affecting all aspects of our financial and social lives with restrictions on travel, professional sports games being postponed, the banning of mass gatherings and the possibility of a global recession. Stock markets around the world have taken a downturn due to a number of reasons including, the coronavirus, the recent drop in oil prices, and the upcoming US election.

We wanted to take this opportunity to provide you with some insight to help you understand how markets have performed, historically, during times of a crisis.

While we cannot predict how things are going to change in the markets, we are certain that, for long-term investors, things will get better. Staying committed to your investment plan is a superior approach than throwing in the towel during a financial storm. Here are some illustrations below:

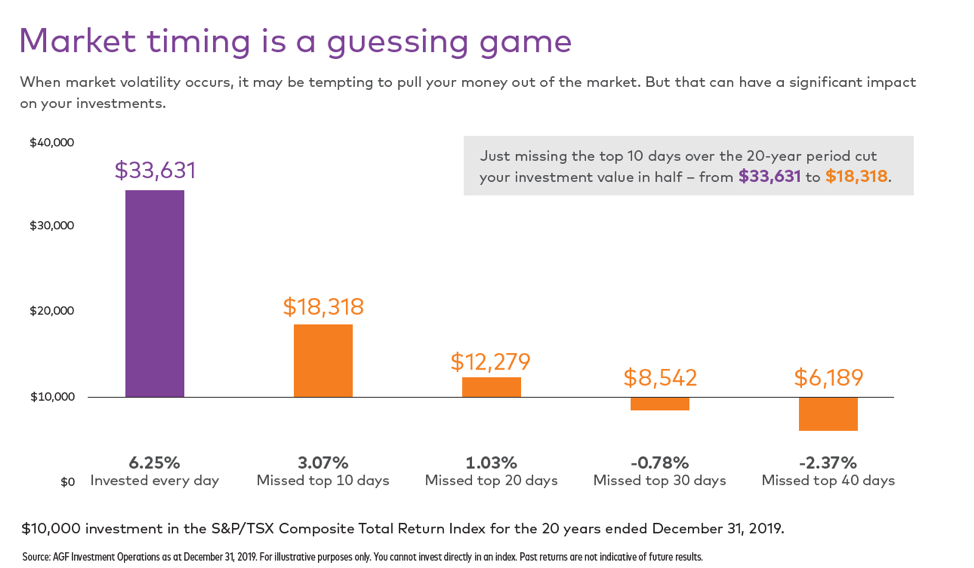

Sell Now? and Invest Later?

Many people are wondering, with the current market volatility, should they sell now and invest later?

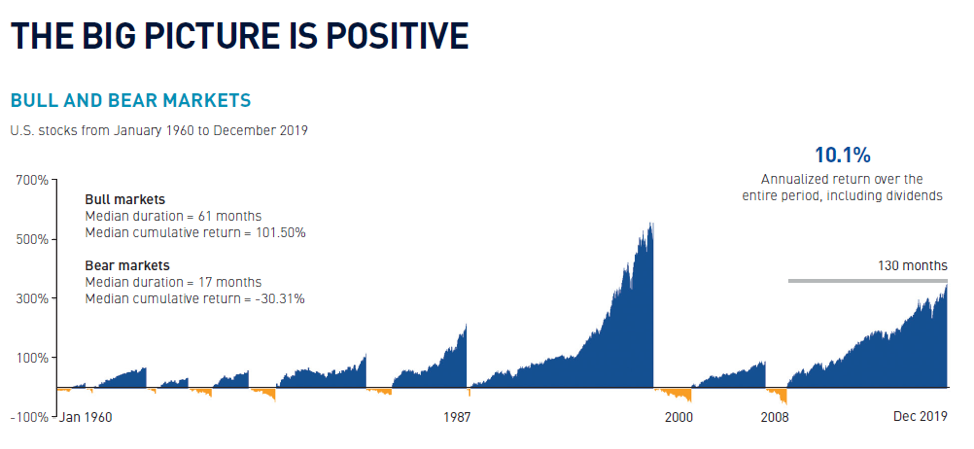

Bull Versus Bear Market:

The duration of a bull market (when the market is doing well) is generally longer than a bear market (when the market is in the negative).

Source: U.S. stocks: S&P 500. Bull and bear market return data are in US$ and do not include dividends. A “bull market” is defined as a gain of 20% or more from the prior low. A “bear market” is defined as a decline of 20% or more from the prior peak.

Source: U.S. stocks: S&P 500. Bull and bear market return data are in US$ and do not include dividends. A “bull market” is defined as a gain of 20% or more from the prior low. A “bear market” is defined as a decline of 20% or more from the prior peak.

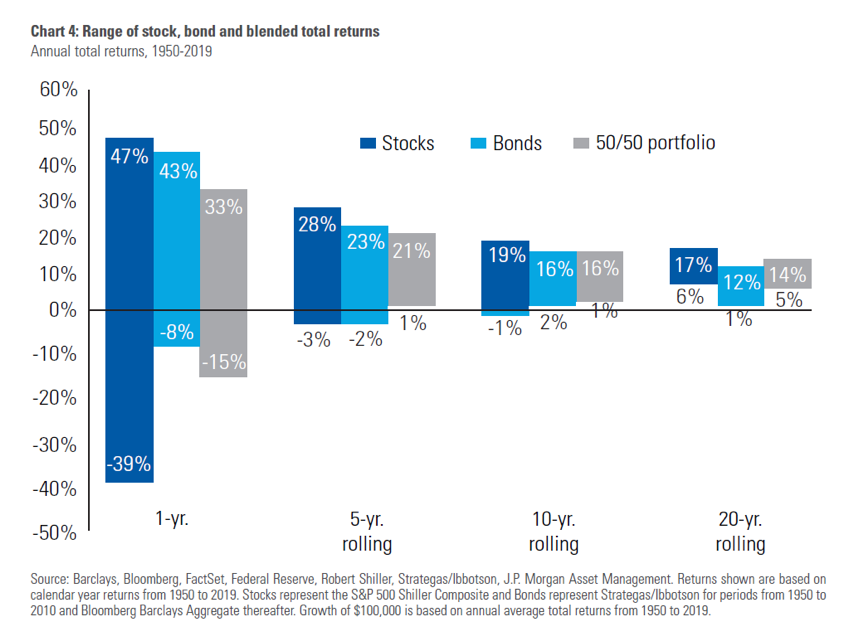

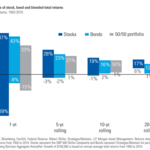

The Longer You Invest, The Smoother The Returns Will Be:

Investing over time will reduce the likelihood of a negative return. See Year 1 below - you may gain up to 47% in returns; however, you can also lose up to -39% in the same year. See Year 20, you may gain up to 17% in returns with no losses.

STRATEGIES TO CONSIDER

Investing during volatile times can challenge your discipline and commitment, but there are principles for your investment strategy that can help ease your mind and keep you focused on the long term.

STICK TO THE PLAN

Perhaps the most significant step you can take towards achieving your long-term goals, is to set them in the first place. Work with your advisor to paint a picture of your future, and then establish a simple, easy-to-follow plan for making it a reality. It’s not difficult, but it does take discipline. Monitoring your progress over time is a great way to stay focused on what matters.

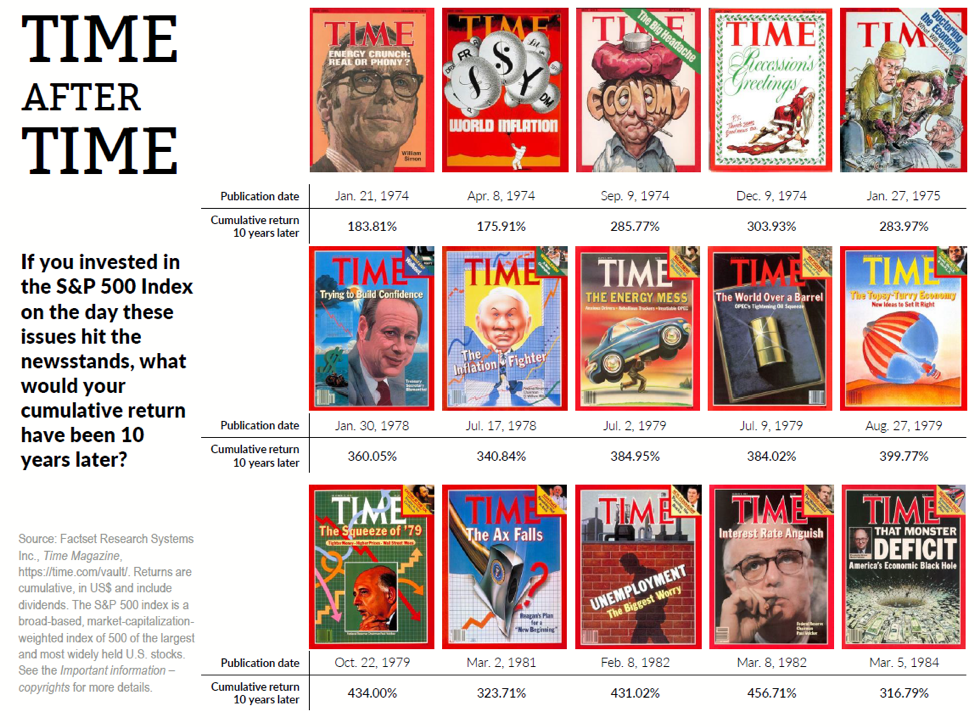

PUT FINANCIAL “NOISE” IN PERSPECTIVE

You may hear suggestions to “ignore” or “tune out” anxiety-inducing market headlines. As humans with natural biases, this is all but impossible. It’s not about ignoring short-term noise. It’s about recognizing it for what it is and seeing that the long-term picture is more positive.

REGULAR REBALANCING

At least once a year, connect with your advisor to rebalance your portfolio. That means selling some of the “winners” and buying more of the “losers.” This practice serves two functions:

- Your portfolio maintains the original asset allocation you established at the beginning

- You force yourself to sell investments that made money (selling high) and buy investments that lost money (buying low)

KEEP INVESTED

Turn market volatility into your advantage. By investing a specific amount at regular intervals, dollar-cost averaging can help you buy more units of an investment at lower prices and fewer at higher prices. This helps take the worry out of making a single lump-sum investment at the wrong time.

Contact Info

- 604.620.6630 Phone

- 604.687.7763 Fax

- consultation@flci.ca

Downtown Office

- 1500 West Georgia St. (19th Floor)

- Vancouver, BC

- V6G 2Z6 Canada

Fairmont Office

- #1417 - 750 West Broadway

- Vancouver, BC

- V5Z 1H8 Canada